Computer Software Bonus Depreciation 2021 . for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the.

from corporatefinanceinstitute.com

for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the.bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their.

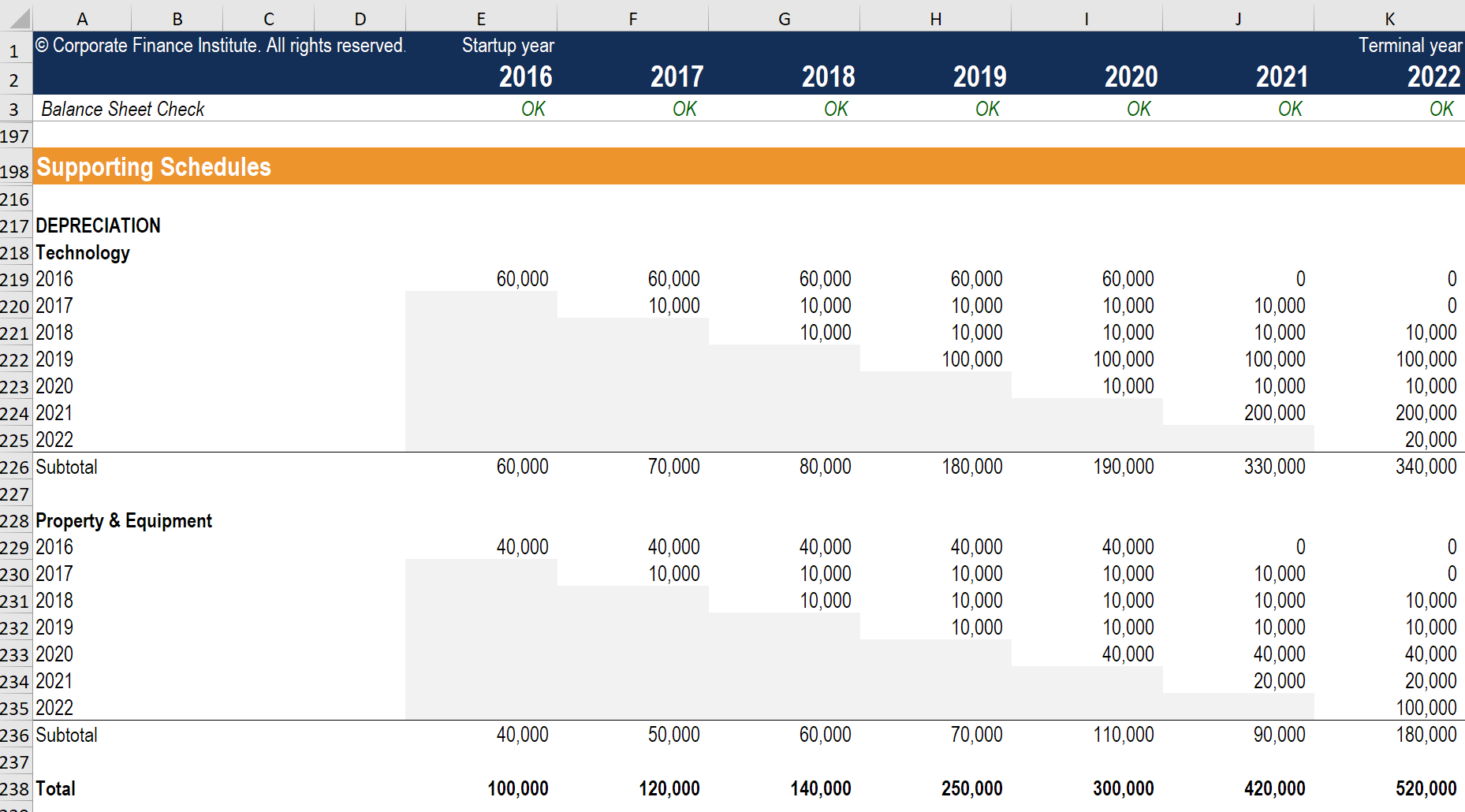

Depreciation Schedule Guide, Example, How to Create

Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment: the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their.

From letmetalknerdytoyou.blogspot.com

Computer Software Depreciation Method / ASSET REGISTER CARD Form.docx Computer Software Bonus Depreciation 2021 the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for the 2021 tax year, section 179 has the following specifications for software equipment:bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s.. Computer Software Bonus Depreciation 2021.

From www.pdffiller.com

Fillable Online Bonus Depreciation and How It Affects Business Taxes Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for tax years beginning. Computer Software Bonus Depreciation 2021.

From www.blockadvisors.com

Bonus Depreciation for Deducting Business Costs Block Advisors Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the.bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for. Computer Software Bonus Depreciation 2021.

From nurgon.com

8 ways to calculate depreciation in Excel (2022) Computer Software Bonus Depreciation 2021 the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar. Computer Software Bonus Depreciation 2021.

From ezddies.com

8 ways to calculate depreciation in Excel (2022) Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. the software is eligible for bonus depreciation, so. Computer Software Bonus Depreciation 2021.

From cyberblogindia.in

Depreciation Rate for Computer and Related Devices The Cyber Blog India Computer Software Bonus Depreciation 2021 the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their.bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software. Computer Software Bonus Depreciation 2021.

From www.slideserve.com

PPT Bonus Depreciation PowerPoint Presentation, free download ID249614 Computer Software Bonus Depreciation 2021bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment: the software is. Computer Software Bonus Depreciation 2021.

From gimmicklove.blogspot.com

Computer Software Depreciation Rate / Car Depreciation Rate As Per Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar year 2022, bonus depreciation. Computer Software Bonus Depreciation 2021.

From www.pinterest.com

Bonus Depreciation What It Is and How It Works in 2021 Tax help, Tax Computer Software Bonus Depreciation 2021bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years. Computer Software Bonus Depreciation 2021.

From www.chegg.com

Solved Compute MACRS depreciation for the following Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the.bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. the. Computer Software Bonus Depreciation 2021.

From globalfinishing.com

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation Computer Software Bonus Depreciation 2021 for the 2021 tax year, section 179 has the following specifications for software equipment:bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their.. Computer Software Bonus Depreciation 2021.

From corporatefinanceinstitute.com

Depreciation Schedule Guide, Example, How to Create Computer Software Bonus Depreciation 2021 the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar. Computer Software Bonus Depreciation 2021.

From www.bmtqs.com.au

Software Depreciation Maximises Cash Flow BMT Insider Computer Software Bonus Depreciation 2021bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software. Computer Software Bonus Depreciation 2021.

From ezequipmentzone.com

Amplify Your Returns with Bonus Depreciation Unveiling the Power of E Computer Software Bonus Depreciation 2021 the software is eligible for bonus depreciation, so the client would then be required to wait until they filed their. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning. Computer Software Bonus Depreciation 2021.

From www.envisioncapitalgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions Computer Software Bonus Depreciation 2021bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years. Computer Software Bonus Depreciation 2021.

From haipernews.com

How To Calculate Laptop Depreciation For Tax Haiper Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment: for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation. Computer Software Bonus Depreciation 2021.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for the 2021 tax year, section 179 has the following specifications for software equipment:bonus depreciation is an accelerated form of depreciation — it. Computer Software Bonus Depreciation 2021.

From business2news.com

What is Bonus Depreciation? Computer Software Bonus Depreciation 2021 for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the. for tax years beginning before calendar year 2022, bonus depreciation applies to developed software to the.bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s. for. Computer Software Bonus Depreciation 2021.